After you listen

• Read Cooper Howard’s 2025 Municipal Bond Outlook (https://www.schwab.com/learn/story/municipal-bond-outlook) .

• Read Collin Martin’s 2025 Corporate Bond Outlook (https://www.schwab.com/learn/story/corporate-bond-outlook) .

• Read Kathy Jones’s 2025 Treasury Bonds and Fixed Income Outlook (https://www.schwab.com/learn/story/fixed-income-outlook) .

• Follow the Schwab Center for Financial Research on X @SchwabResearch (https://x.com/schwabresearch) .

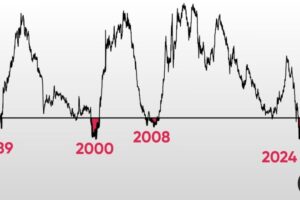

Is the bond market caught between the Federal Reserve’s plans to cut interest rates and the risk of higher inflation and federal debt levels? In Part 2 of our 2025 Market Outlook, we focus on the fixed income markets, including corporate and muni bonds.

First, Kathy Jones interviews Collin Martin about his outlook for investment-grade corporate bonds, floating-rate notes, and preferred securities.

Next, Cooper Howard offers his outlook on the municipal bond market. He and Kathy also discuss credit quality and the implications of potential tax law changes.

Finally, Kathy gives her 2025 outlook for Treasuries and the fixed income markets overall.

On Investing is an original podcast from Charles Schwab (https://schwab.com) . For more on the show, visit schwab.com/OnInvesting (https://schwab.com/OnInvesting) .

If you enjoy the show, please leave a rating or review on Apple Podcasts (http://getpodcast.reviews/id/1711806955) .

Important Disclosures

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

Investing involves risk, including loss of principal.

Past performance is no guarantee of future results and the opinions presented cannot be viewed as an indicator of future performance.

Performance may be affected by risks associated with non-diversification, including investments in specific countries or sectors. Additional risks may also include, but are not limited to, investments in foreign securities, especially emerging markets, real estate investment trusts (REITs), fixed income, municipal securities including state specific municipal securities, small capitalization securities and commodities. Each individual investor should consider these risks carefully before investing in a particular security or strategy.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Fixed income investments are subject to various other risks including changes in credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications, and other factors. Lower rated securities are subject to greater credit risk, default risk, and liquidity risk.

Preferred securities are a type of hybrid investment that share characteristics of both stock and bonds. They are often callable, meaning the issuing company may redeem the security at a certain price after a certain date. Such call features, and the timing of a call, may affect the security’s yield. Preferred securities generally have lower credit ratings and a lower claim to assets than the issuer’s individual bonds. Like bonds, prices of preferred securities tend to move inversely with interest rates, so their prices may fall during periods of rising interest rates. Investment value will fluctuate, and preferred securities, when sold before maturity, may be worth more or less than original cost. Preferred securities are subject to various other risks including changes in interest rates and credit quality, default risks, market valuations, liquidity, prepayments, early redemption, deferral risk, corporate events, tax ramifications, and other factors.

Tax-exempt bonds are not necessarily a suitable investment for all persons. Information related to a security’s tax-exempt status (federal and in-state) is obtained from third parties, and Schwab Center for Financial Research does not guarantee its accuracy. Tax-exempt income may be subject to the Alternative Minimum Tax (AMT). Capital appreciation from bond funds and discounted bonds may be subject to state or local taxes. Capital gains are not exempt from federal income tax.

Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical …