U.S. BOND MARKET COLLAPSE Begins—Japan Just Said “NO” to Trump’s Ultimatum!

🇺🇸💣 DEBT DESPERATION: Has America Just Pushed Japan Too Far? 💣🇯🇵

The United States is drowning in debt—and now it’s pressuring its closest allies to bail it out. But Japan has had enough.

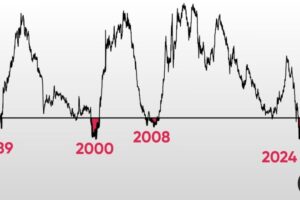

This video exposes how Trump’s aggressive economic ultimatums are turning the once-strong U.S.–Japan alliance into a ticking financial time bomb. With Tokyo holding $1.1 trillion in U.S. Treasury bonds, Japan has the power to ignite a global bond market collapse that could send U.S. interest rates soaring, destroy the dollar, and trigger global financial chaos. 🌍📉

🧠 WHAT YOU’LL LEARN:

Why Japan is refusing to fund America’s deficit.

How de-dollarization is accelerating across global markets.

What Japan’s $1.1 trillion Treasury threat really means.

Why Trump’s tariffs could backfire into full-scale economic warfare.

How the destruction of trust in U.S. debt could crash Wall Street.

And why the collapse of this alliance might reshape the global order.

🚨 KEY STATS:

– U.S. Current Account Deficit: 3.8% of GDP (~$1T/year)

– Foreign Participation in Treasury Auctions: Just 14%

– U.S. Dollar 2025 YTD: Down 10–11%

– Japan’s Debt-to-GDP: 236% – highest in the developed world

– BOJ Bond Ownership: 80% of domestic bonds

– Tariff Damage to Japan: Over $1.3B losses to Toyota in 60 days

🔥 THE IMPOSSIBLE ULTIMATUM:

Trump’s administration is demanding Japan raise rates and buy more U.S. debt. But Japan’s economy is already fragile—with shrinking GDP, falling exports, and consumer spending on life support. The result? Economic warfare. Japan is now threatening to dump its Treasury holdings—a move that could spike inflation, crush bond markets, and force the U.S. into a fiscal corner. This isn’t a negotiation—it’s a stand-off with nuclear financial consequences.

🌐 A GLOBAL SHIFT BEGINS:

Japan is boosting trade with CPTPP nations, deepening ties in the Middle East, and cutting reliance on U.S. imports. Meanwhile, foreign central banks are ditching dollars and pivoting to gold, euros, and yuan. Even Japan’s finance minister now admits their U.S. bond holdings are a bargaining chip. The world’s second-largest foreign creditor just declared it’s DONE playing by America’s rules.

😱 THE REAL THREAT?

It’s not just Japan pulling the trigger.

It’s the collapse of U.S. credibility.

When allies can weaponize your debt, your empire is already crumbling.

📉 WHAT HAPPENS IF JAPAN SELLS?

Interest rates skyrocket.

Wall Street tanks.

Mortgage and loan costs explode.

The dollar collapses.

U.S. global influence shrinks.

And inflation wipes out American households.

🗣️ THE MESSAGE FROM TOKYO:

Prime Minister Ishiba calls this “a fight for national interests.”

Kato warns: “No plan to sell… yet.”

Translation: Washington has one last chance to change course before Japan detonates the Treasury bomb.

This isn’t just another trade spat—it’s a geopolitical financial reckoning. And it’s already begun.

📲 LIKE, COMMENT & SUBSCRIBE

If you want more brutal truths on debt, trade wars, and the collapse of U.S. economic dominance, smash that like button and subscribe for future breakdowns.

🔍 TAGS:

#TrumpVsJapan #USDebtCrisis #JapanTreasuryDump #BondMarketCollapse #Geopolitics #FinancialWarfare #GlobalRecession #DollarCollapse #EconomicWar #CPTPP #DeDollarization #WallStreetCrash #TrumpTariffs #USJapanAlliance #FiscalCrisis #2025Economy #InflationSpike #DebtUltimatum #TreasuryYields #BOJ #GlobalFinance